Biweekly Mortgage Calculator

Introduction:

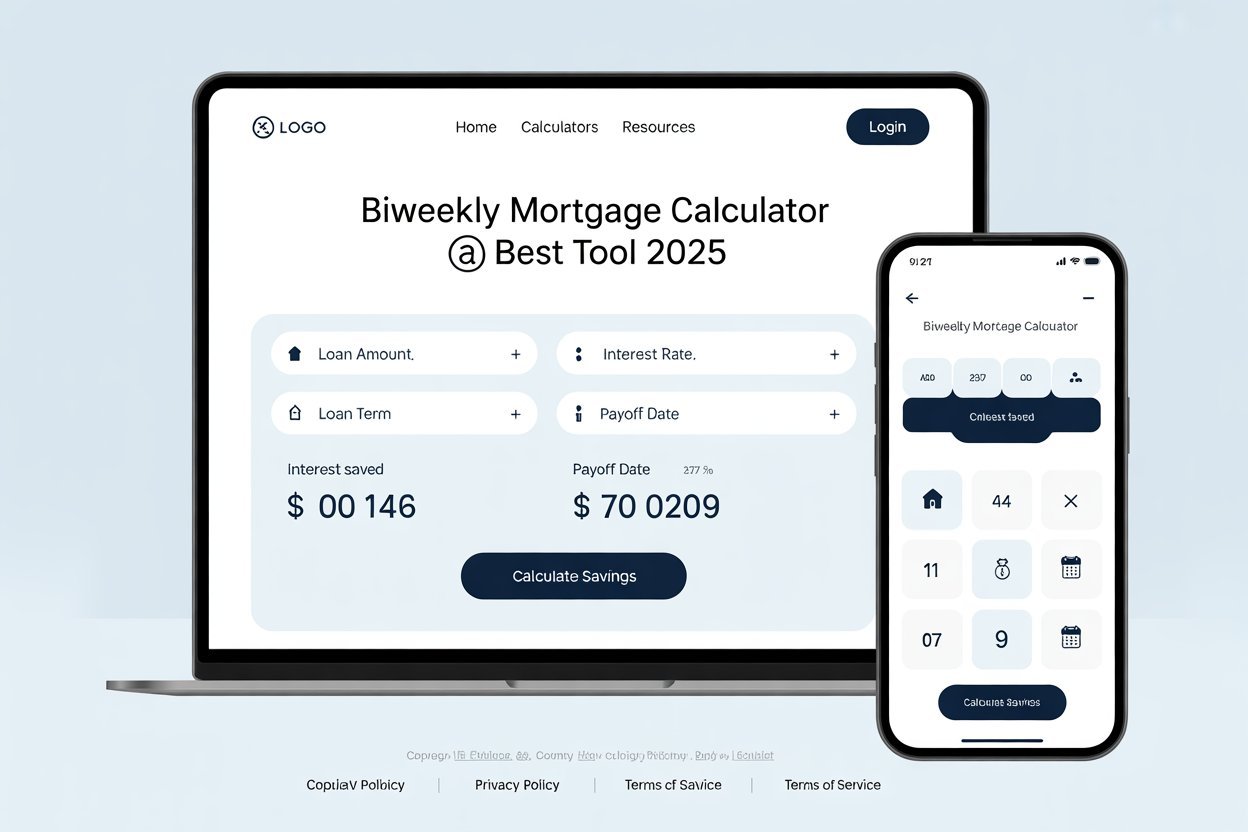

A biweekly mortgage calculator can be one of the most effective tools homeowners use to save money on their mortgages in 2025. The faster you can pay off your mortgage, the less it will cost overall in terms of interest paid, and this calculator allows you to see exactly how much you need to save to achieve that goal. Whether you’re a first-time home owner or a financial pro toiling away on behalf of clients, this guide will walk you through how biweekly payments work, how the calculator works, and how to make smart financial decisions.

Biweekly Mortgage Calculator: What Is A Biweekly Mortgage Calculator and How Does It Work?

A biweekly mortgage calculator is an online tool that shows you how paying on a biweekly basis, rather than once a month, can help reduce your loan term and save you money in interest.

Simple Explanation for Beginners

Instead of paying 12 monthly payments annually, biweekly means you pay half a payment every two weeks. But because there are 52 weeks in a year, you make 26 half-payments every year. Essentially, that would be equivalent to making 13 full payments per year. That additional payment each year is applied directly to your principal balance, helping you pay off your loan more quickly.

How Biweekly Payments Save You Money

Each additional dollar you send in reduces the amount of interest owed on it. That can save you tens of thousands of dollars over the course of a 30-year mortgage. Here’s what a good biweekly mortgage calculator will show you:

- Your new loan payoff date

- Total interest savings

- How much time do you save from your mortgage?

Technical Breakdown for Finance Pros

For those in finance, there is a greater incentive to schedule payments on a bi-weekly basis, as it effectively shortens the loan’s length by accelerating principal reduction. The amortization formulas are typically triggered by recalculating interest for 26 annual payments in a year, rather than 12, so that the principal is more quickly amortized and thus has a relatively lower total interest cost.

Advantages of a Biweekly Mortgage Calculator

Interest Savings and Faster Payoff

The greatest advantage of biweekly payments is interest savings. You could also get the balance paid off more quickly by paying an extra month’s worth of principal each year. That is because interest accumulates on a lower balance every month.

Build Equity Faster

Another advantage of paying down your loan balance more quickly is that you build home equity more quickly. This can be useful if you’d like to sell the house in the future or refinance.

Financial Planning Advantages

This is an excellent way to spread payments so that they are more evenly distributed over the year and can therefore improve cash flow. Many families find it easier to deal with half-payments every two weeks than one large monthly payment.

How to Use Our Biweekly Mortgage Calculator (Step-by-Step Guide)

It’s easy and will only take a minute to find out with a biweekly mortgage calculator.

Enter Your Loan Details

Enter some financial details, such as:

- Loan amount (principal)

- Annual interest rate

- Loan term (in years)

- Start date

Customize Your Payment Plan

Some calculators allow you to add additional principal payments or lump-sum contributions. This enables you to understand how much more you could save by paying extra.

View Your Results Instantly

The calculator will display:

- Your new payoff date

- Total interest saved

- A detailed amortization schedule

This allows you to compare monthly and biweekly payments side by side.

Biweekly Mortgage Payments vs Monthly Payments

| Payment Type | Payments per Year | Total Payments | Payoff Speed | Interest Savings |

| Monthly Payments | 12 | 360 (30 years) | Standard | Standard |

| Biweekly Payments | 26 half-payments (13 full) | ~312 (around 25-26 years) | Faster | Significant |

Which Option Is Best for You?

Biweekly payments make sense if you receive a paycheck every two weeks and you want to pay off your debt more quickly. If you prefer predictable budgeting or if your income fluctuates, monthly payments may be the best option for you.

Is a Biweekly Mortgage Right for You in 2025?

When It Makes the Most Sense

- You have a reliable source of income and can afford to make regular bi-weekly payments.

- You are trying to accelerate the payoff of your mortgage.

- You want to save on interest and build equity more quickly.

When to Avoid It

- You have other, high-interest debt to pay off first.

- Your lender is charging you a fee for making bi-weekly payments.

- Your income is inconsistent, and you struggle to keep up with semi-monthly payments.

Pro Tips to Maximize Your Mortgage Payoff

Blend Biweekly Payments with Additional Principal Payments

Rounding up and paying just a little extra on your principal can add up to big savings.

Strategize the Use of Windfalls (Tax Refunds, Bonuses)

Use any windfall to pay down your mortgage and knock out years of payments.

Refinance When Rates Drop

If you can get a refi at lower rates in 2025, do that and keep making bi-weekly payments.

Common Mistakes to Avoid

Forgetting to Verify Lender Support

Not all lenders automatically apply biweekly payments. Ensure your additional payments are applied to principal and not simply held until the end of the month.

Ignoring Other Financial Goals

While it’s great if you qualify to pay off your mortgage early, also be sure to save for retirement, emergencies, and other goals at the same time.

Check Out Our Free Biweekly Mortgage Calculator Now

Curious how much you may save? Plug in the numbers using our free biweekly mortgage calculator and get instant results. It’s quick, secure, and no email is needed. You’ll know the exact amount of interest you can save, and when you will be mortgage-free.

Final Thoughts

A biweekly mortgage calculator is one of the simplest methods to see how making an extra payment will save you thousands and get rid of your debt years earlier. In 2025, when interest rates and housing costs are on the brain for many households, this kind of tool could offer the kind of insight that will help you make better financial decisions.

Use our calculator and spend a few minutes today to find out how much you could save.

Related Tools

Check out our health related tools at: Healthy Vibes24

Also check out Finance related tools at: All Tools Co

FAQs: Biweekly Mortgage Calculator

How much faster can I pay off my mortgage with biweekly payments?

For a 30-year mortgage, biweekly payments can reduce the term to around 25–26 years.

Do biweekly mortgage payments really save money?

Yes. The additional payment each year partially reduces the principal faster, thereby reducing the total interest paid.

Can I set up biweekly payments myself without my lender?

Yes. You can do an extra payment yourself by splitting your monthly payment in half and paying every two weeks.

What happens if I miss a biweekly mortgage payment?

Missed payments can cause you to forfeit the faster payoff benefit and may result in late fees. Always communicate with your lender.

Is it better to make biweekly payments or one extra payment per year?

Both achieve similar results. Biweekly payments are automated; one extra a year takes discipline.

Will a biweekly mortgage affect my credit score?

No. How often you pay in installments doesn’t affect your credit as long as you’re making payments on time.

Can I switch back to monthly payments later?

Yes, with most lenders, you can switch back to making monthly payments if necessary.

How accurate are online biweekly mortgage calculators?

The good calculators use the standard amortization method and are quite accurate, provided you enter all the necessary information.

One thought on “Biweekly Mortgage Calculator | Best Tool 2025”